Macro Overview of Canada

- Slipping on world competitiveness

- Census : Toronto and Vancouver

- Target exit has little impact on Landlords

- Most expensive Office space in Canada

- Foreign ownership - hard to track statically - CMHC

Exclusive: Canada plans forensic audits of millionaire migrants’ finances

PUBLISHED : Tuesday, 09 December, 2014

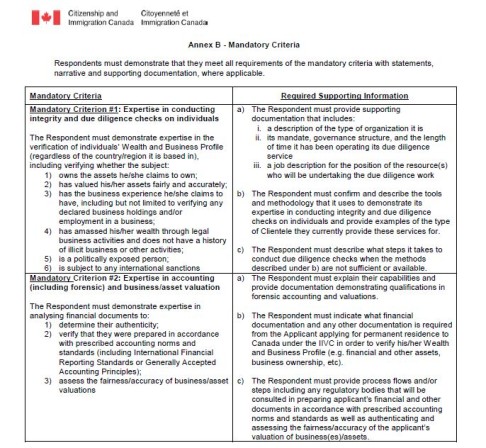

Applicants to Canada’s new millionaire migration scheme will have their finances subjected to an intensive forensic audit by private-sector accountants, government tendering documents have revealed.

The auditors will also be required to investigate whether applicants have any criminal past or whether they are “politically exposed”.

The unprecedented scrutiny could act as a deterrent to some wealthy mainland Chinese, who made up a large majority of applicants to the now-defunct Immigrant Investor Programme, which is soon to be replaced by the Immigrant Investor Venture Capital (IIVC) scheme.

Details of the IIVC programme have yet to be officially unveiled by Ottawa, but documents on a government procurement website reveal that Citizenship and Immigration Canada is seeking private-sector expertise to ensure that all applicants meet the scheme’s wealth requirements, and that their fortunes have been legally obtained.

Among the mandatory requirements of those seeking the auditing tender, which closed on Friday, the documents list “expertise in conducting integrity and due diligence checks on individuals”, and “expertise in accounting (including forensic) and business/asset valuation”.

The auditors will also have to confirm whether an applicant has any history of criminal activity and whether they are a “politically exposed person”. The documents did not elaborate on who this might include.

A Canadian immigration industry source said the audit “would present certain problems to certain individuals, from certain countries”.

Although applicants to the old IIP were also required to confirm that their wealth was legally obtained, the scrutiny was much less rigorous than that promised under the new scheme, said the source, who was consulted by Citizenship and Immigration Canada on its plans.

“Now they are talking about a third-party, private-sector, accountable audit, as opposed to an immigration officer looking at a bunch of numbers and trying to come up with a sound rationale for whether the funds were obtained illegally or not,” the source said.

“Presumably one of the large accounting firms, or two or three large accounting firms, will qualify to perform these [audits], and I believe that their structural understandings will be more formal and less subjective than those employed by immigration officers in the past.”

The old IIP was shut down in June, resulting in about 60,000 rich applicants and their dependents being axed from the immigration queue, including some 45,000 mainland Chinese. That scheme had required immigrants worth a minimum of C$1.6 million to loan Canada C$800,000 interest free for five years, in return for permanent residency. It was widely criticised for allowing immigrants to buy their way into Canada.

The government promised that the scheme would be replaced with the IIVC programme, but immigration industry sources recently told the South China Morning Post that the new scheme would be tiny in comparison, only approving about 50 applications per year.

Beijing has long complained that Canada’s immigration system has played a role in harbouring Chinese criminals. Last month, Xu Hong, director-general of the Chinese foreign ministry’s department of treaty and law, told a press conference that Canadian and US judges were “prejudiced” against mainland courts and thus reluctant to repatriate businessmen and officials who were fugitives from Chinese law.

According to an account by Reuters, Xu said Canada and the US were the two immigration destinations most favoured by Chinese economic criminals. Neither Washington nor Ottawa has an extradition treaty with China.

Under the tender criteria for the IIVC scheme, applicants will have to submit documentation that allows auditors to finalise their checks in three weeks. This could be extended if required by the auditors. “If the reason for not being able to conduct the required work within the established timelines is the lack of cooperation from the Applicant, this should be indicated in the report,” CIC warns.

The report would be initially submitted by the auditors to the applicant, who would then pass them on to CIC with their completed application. This would apparently give applicants whose audits reveal criminality or other dubious activity the opportunity to abort their applications.

CIC has declined to reveal the financial details of the IIVC scheme before its official launch, which is expected within weeks. However, two immigration industry sources told the Post they were consulted by CIC about the scheme and were told applicants would get permanent residency in exchange for investing C$2 million in a venture capital fund. The applicants would get no say in how their money was invested by the fund’s managers.

A report in the Wall Street Journal last month said the investment per applicant would be C$1 million to C$2 million, and that the target size of the fund would be C$120million, suggesting 60 to 120 applicants would be accepted.

- Canada supports China's anti corruption

- Canada choice destination to Invest in Real Estate

- E&Y: Canada Amongst Top 5 to Invest in Real Estate

- Institutions - Sale & LeaseBacks

- 7% pay 47% of taxes

- Developers pay for Transit Stations

- City of Vancouver has received a serious legal rebuke from the B.C. Supreme Court, which has quashed approvals for two downtown towers where the city swapped land and approved more density to a developer in exchange for social housing. The ruling has left the city and developer scrambling unsure whether construction on the social-housing project has to be halted immediately.

Exclusive: How mainland Chinese millionaires overwhelmed Canada's visa scheme

EXCLUSIVE

Applications by tens of thousands of mainland millionaires flooded Canada's consulate in Hong Kong and overwhelmed the country's investor immigrant programme, an investigation by the South China Morning Post has revealed.

EXCLUSIVE

Applications by tens of thousands of mainland millionaires flooded Canada's consulate in Hong Kong and overwhelmed the country's investor immigrant programme, an investigation by the South China Morning Post has revealed.

Applications by tens of thousands of mainland millionaires flooded Canada's consulate in Hong Kong and overwhelmed the country's investor immigrant programme, an investigation by the South China Morning Post has revealed.

Considerations Impacting Canada's growth

Double click above article to read

[VANCOUVER] Petroliam Nasional Bhd (Petronas), Malaysia's state-owned energy company, is seeking to cut its stake further in a liquefied natural gas (LNG) project in Canada. It will add partners as it moves to build the country's first gas export terminal.

The company aims to reduce its share of Pacific NorthWest LNG to as low as 50 per cent from 90 per cent by selling stakes to Asian gas buyers, said Greg Kist, Pacific NorthWest's president.

New partners would ideally acquire proportionate shares of the whole project, including the gas reserves and its pipeline and processing facilities that chill the gas into a liquid for transport by ship, Mr Kist said at Pacific NorthWest's headquarters in Vancouver last week.

"We continue to look for off-take partners - obviously there are many discussions going on," he said, adding that stake sales would be modelled on Japan Petroleum Exploration's investment in Pacific NorthWest. "They would be full equity off-take partners."

CNOOC takes hit from Nexen deal

BEIJING -- CNOOC Ltd.'s financial performance is being hurt by its purchase of Nexen Inc., a situation exacerbated by its pledge to Ottawa that it will not reduce its newly-acquired Canadian staff, the Chinese company's own leading analyst says.

Earlier this year, CNOOC completed its $15.1-billion (U.S.) takeover of the Calgary-headquartered energy producer, consummating the single largest foreign takeover by a Chinese company after a long review by the federal government.

As part of that, CNOOC made a series of undertakings to the Canadian government. It promised to keep its North American headquarters in Calgary, make greater long-term investments in the oil sands and list on the Toronto Stock Exchange. So far, the state-owned oil company has made good on those and has been publicly bullish on its new purchase. In September, CNOOC chief executive Li Fanrong said: "Everything is meeting our expectations. We are, right now, in the process of a discussion on how to maximize our investment."

But in an interview in Beijing, Chen Wei Dong, CNOOC's chief energy researcher, outlined the difficulties the company has encountered since taking on Nexen, whose key foothold in the oil sands, its troubled Long Lake operation, is showing no sign of operating at its full capacity of 72,000 barrels of bitumen a day.

CNOOC's company-wide return on investment "on average surpasses 11 per cent," compared with 3.5 per cent for the Nexen assets, Mr. Chen said.

"So that is a problem. That is a concern," he said.

In particular, Mr. Chen raised "the problems of human resources." Nexen has approximately 3,200 employees around the world, with about half in Canada.

Mr. Chen recounted previous energy mega-mergers, including those between Chevron and Gulf, Exxon and Mobil, BP and Amoco - each was followed by large-scale layoffs in the acquired company.

By contrast, CNOOC in taking over Nexen pledged to the Canadian government, "no reduction in manpower," he said. "I myself am unable to see how to improve the efficiency of Nexen if we continue this route."

Mr. Chen occupies an unusual role within CNOOC. Although he works for the company, he does so as a researcher. In that sense, his comments are, in some measure, his own; the company says he does not speak for it. He also hastens to point out that CNOOC has "made promises and we will honour the promises we have made." (When the government approved the transaction a year ago, the company said it "will seek to retain Nexen's current management team and employees.")

No one at Nexen's corporate headquarters in Calgary was available to comment on Mr. Chen's assertions.

Still, his comments provide insight into how Nexen's new owner may be reconsidering its views of deals. Previous takeovers of major Canadian companies have been accompanied by bold promises that were rescinded when circumstances changed, often at the cost of jobs. The federal government took legal action in one instance, suing U.S. Steel Corp. in 2009 for breaking commitments to protect employment after the takeover of Stelco Inc.

CNOOC's troubles with Nexen are set against a broader pivot by China's energy giants, which have been at the heart of a panglobal buying spree. After a decade of 32 per cent annual compound growth in foreign mergers and acquisitions, China spent $64.6-billion on outbound acquisitions in 2012, according to a recent Accenture report.

Virtually all of those deals have come from major state-owned enterprises, and two-thirds of the natural resources spending in the past decade has been on buying up oil and gas. In part, that was to fulfill a mandate to secure barrels for an energy-thirsty rising superpower.

Now, that mandate is changing. "It's fair to say that Chinese companies, especially the [state-owned enterprises] in the process of expanding their scale, we have to learn how to improve our efficiency and competitiveness in the global market," Mr. Chen said.

He pulled out a printout of a recent report from Accenture, titled "The Dragons are on the Move," that offers suggestions to maximize efficiency from new acquisitions.

He underlined sections that say Chinese companies have, until now, not focused on "developing an integration road map" to create business value from those deals.

Chinese companies are increasingly attuned to the financial impact of failing to address those matters, he said.

Mr. Chen offered hope for future investment in Canada, particularly in a liquefied natural gas export project CNOOC is now pursuing in northern British Columbia. He likened the switch from oil to natural gas to the switch from coal to oil: It will be a market transformation that will provide decades of demand for gas, he said, defying the critics who suggest Canada is moving too slowly to win its share of the global LNG market.

"The International Energy Agency predicts that the 21st century is the golden age for natural gas. I endorse this point," he said.

Oil has been the king of fossil fuels for over a century, he said. If gas is its successor, its reign is also likely to be lengthy. "So what would be the concern for Canada?" he said. "There is no reason for worry."

With a report from reporter Kelly Cryderman in Calgary

-- 2013 December 4 GLOBE & MAIL Report on Business

The caravan has moved on to other places

At a recent conference at Beijing’s Four Seasons Hotel, one of many featuring trade missions from Canada promoting energy-related investment, Feng Zhiqiang wondered aloud about the next blockbuster Chinese energy deal in Alberta’s oil patch.

“If Sinopec decides to do its own Nexen, what would Canada do?” the chief executive and chairman of Sinopec Daylight Energy Ltd. asked.

The question was put to Canadian political and energy powerbrokers, including Joe Oliver, Canada’s natural resources minister, Rich Coleman, B.C.’s natural gas minister, Alberta energy minister Ken Hughes and David Collyer, the head of the Calgary-based oil industry association.

“The room virtually went silent,” recalled Wenran Jiang, director of the Canada-China Energy and Environment Forum and an advisor to the Alberta government on China, who organized the event that day. “Nobody was able to answer that question.”

...The big three state-run Chinese companies — CNOOC, PetroChina and Sinopec — are showing mixed results. Exact numbers are hard to come by, executives shun public interviews and progress reports are rare and often opaque — a low profile cultivated partly as a result of not wanting to create waves. But interviews with bankers, industry insiders, lawyers and government officials suggest the companies are on a steep learning curve. -- 2013 December MORE

- Felix Chee out at CIC in Toronto because of Canadian losses

- Harper not finding China easy

http://www.bloomberg.com/news/2013-12-06/great-wall-of-canadian-energy-keeps-chinese-on-outside.html - http://read.thestar.com/?origref=https%3A%2F%2Fwww.google.ca%2F?origref=https%3A%2F%2Fwww.google.ca%2F#!/article/527d7859cb0071f80aa6ab71-foreign-investment-doesn-t-need-absolute-clarity-harper

Children of rich Chinese home alone in Canada face challenges

When Danny Kuo was 18 years old, he was living alone in a large home in the exclusive Vancouver neighbourhood of Dunbar. He was a pre-medical student at the University of British Columbia.

Canada - Retail

Here’s the list, the number of locations and the year the chain closed:

Jones New York, 36, stores, 2015

Target, 133 stores, 2015

Sony, 14 stores, 2015

Mexx, 95 stores, 2015

Smart Set, 107 stores, 2014

Bombay, Bowring & C0. Inc. and Benix & Co. Inc. 110 stores, 2014

Jacob, 92 stores, 2014

Juicy Couture, 5 stores, 2014

Grand & Toy, 19 stores, 2014

Petcetera, 18 stores, 2014

Big Lots/Liquidation World, 78 stores, 2014

Zellers, 220 stores, 2013

Espirit, 46 stores, 2012

Fields, 141 stores, 2012

Target, 133 stores, 2015

Sony, 14 stores, 2015

Mexx, 95 stores, 2015

Smart Set, 107 stores, 2014

Bombay, Bowring & C0. Inc. and Benix & Co. Inc. 110 stores, 2014

Jacob, 92 stores, 2014

Juicy Couture, 5 stores, 2014

Grand & Toy, 19 stores, 2014

Petcetera, 18 stores, 2014

Big Lots/Liquidation World, 78 stores, 2014

Zellers, 220 stores, 2013

Espirit, 46 stores, 2012

Fields, 141 stores, 2012

-- 2015, Jan 30 PROVINCE

No comments:

Post a Comment